Essential Financial Reports Every Small Business Owner Needs to Review Monthly

- Susan Hagen

- Aug 26, 2025

- 4 min read

Running a small business means wearing a lot of hats—and one of the most important is keeping tabs on your finances every single month. If you’re only glancing at your numbers once a quarter (or, let’s be honest, just at tax time), you’re flying blind. Monthly financial reports are your business’s health check—they help you spot issues early, take advantage of opportunities, and plan ahead with confidence.

Here’s a practical guide to the essential financial reports every small business owner should review monthly, along with why they matter and what you should look for in each.

1. Profit and Loss Statement (Income Statement)

What it is: Your profit and loss (P&L) statement shows your business’s revenues, costs, and expenses over the past month. It answers the basic question, “Did my business make money or lose money this month?”

Why you need it monthly: Revenue and expenses can change fast—maybe you ran a sale, spent more on advertising, or overtime crept up. The P&L spotlights these trends, so you know what’s working and where things are slipping. Regular reviews help you:

See if you’re hitting sales targets

Track your gross and net profit margins

Pinpoint unnecessary expenses or leaks

Make quick decisions on pricing, marketing, or staffing

Key sections to focus on:

Total revenue (top line)

Cost of goods sold (COGS)

Gross profit (revenue minus COGS)

Operating expenses (like rent, advertising, salaries)

Net profit/loss (bottom line)

If you notice your expenses inching up or profits dipping—even just a little—it’s your cue to look deeper and take action before small issues become big problems.

2. Balance Sheet

What it is: The balance sheet is your business’s financial snapshot at a specific point in time. Think of it as a freeze-frame of what you own and owe:

Assets: What your business owns (cash, inventory, receivables, equipment)

Liabilities: What your business owes (loans, credit cards, bills due)

Equity: The owner’s share (what’s left if you paid off all debts)

Why you need it monthly: Reviewing the balance sheet each month helps you see how your assets and liabilities are changing—are you building wealth or taking on extra debt? You’ll be able to:

Monitor trends in cash and inventory

Ensure debts aren’t piling up

Track owner’s equity growth

Check liquidity (can you pay your short-term bills with your current assets?)

Quick tips:

Watch your current ratio (current assets divided by current liabilities)—if it drops below 1, you might have trouble meeting short-term obligations.

Compare your balance sheet to previous months to spot red flags before they escalate.

Lenders, investors, and the IRS often look at your balance sheet—keeping it up to date puts you ahead of the game.

3. Cash Flow Statement

What it is: The cash flow statement tracks all the money moving in and out of your business—and it’s different from your P&L. The cash flow statement shows where you’re actually collecting and spending cash, which is critical for paying bills and making payroll.

Why you need it monthly: You can be profitable “on paper” but run out of cash if customers pay late or expenses spike unexpectedly. Regular reviews tell you:

If cash coming in covers cash going out

When you might need a line of credit or to tighten spending

How much cushion you have for emergencies or opportunities

Key sections:

Operating activities (core business, sales/expenses)

Investing activities (buying/selling equipment)

Financing activities (loans, investor funds, owner draws)

Positive cash flow month after month means you can breathe easy. Negative cash flow? Time to act quickly—maybe by speeding up collections or delaying purchases.

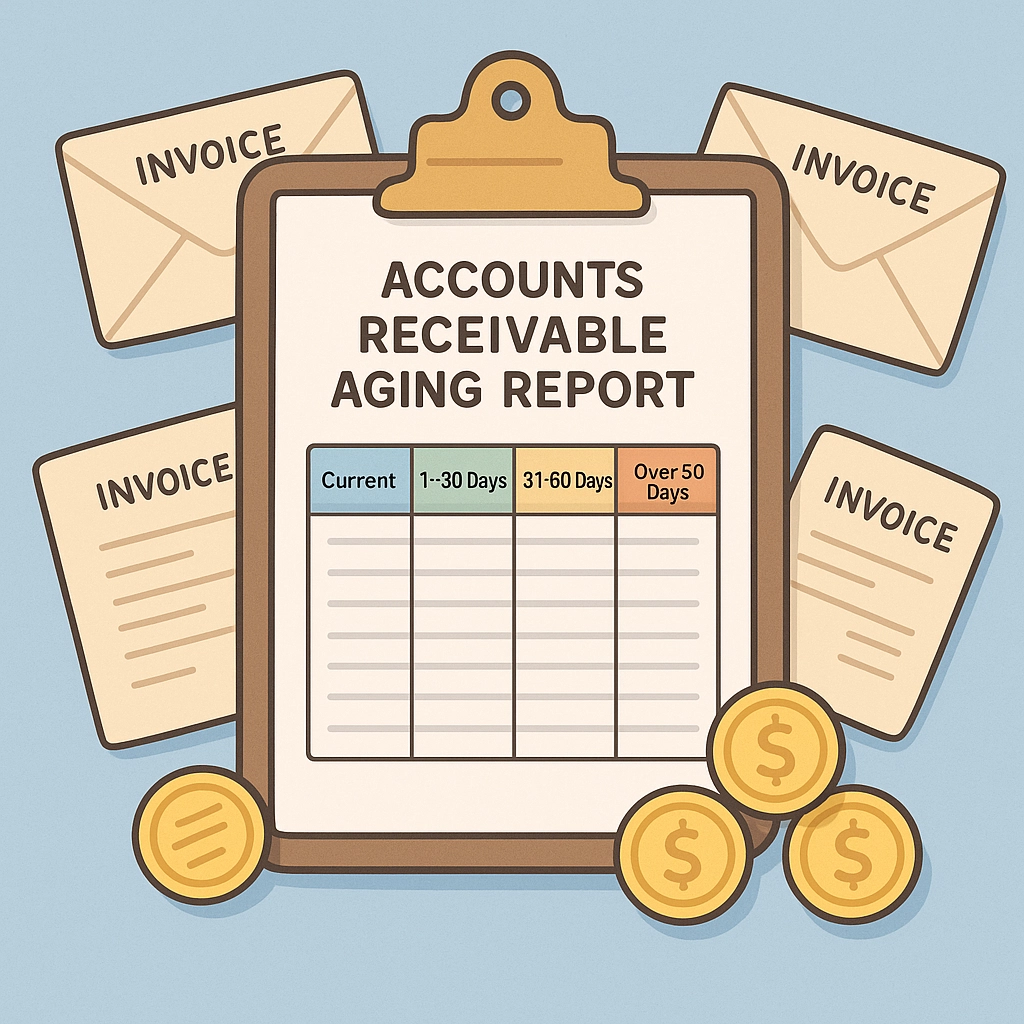

4. Accounts Receivable Aging Report

What it is: This report lists all outstanding invoices and how long they’ve gone unpaid—broken down by time buckets (current, 30, 60, 90+ days).

Why you need it monthly: It’s easy to lose track of who owes you money, especially if you’re busy growing your business. Reviewing the AR aging report each month helps you:

Identify overdue customers quickly

Send timely reminders so cash doesn’t stall

See if you need to revise your payment terms or policies

Flag any invoices stuck in the “over 60 days” column—that’s money at risk. Tight AR management keeps your cash flow healthy and reduces bad debt.

5. Accounts Payable Aging Report

What it is: Just like receivables, this report shows what you owe vendors and how long those bills have been outstanding.

Why you need it monthly: Missing a payment can hurt your credit and supplier relationships. This report gives you a real-time picture so you:

Never overlook a due bill

Prioritize which vendors to pay first

Spot cash flow squeezes before they become emergencies

Set a routine to check payables monthly, and you’ll avoid late fees, keep suppliers happy, and may even negotiate early-payment discounts.

6. Optional (but Smart): Cash Basis Cash Flow Forecast

What it is: While it’s not a “historical” report, adding a simple cash flow forecast can be a game-changer. Predict your future cash in and out over the next month or quarter.

Why you need it monthly: It answers: “Will I have enough cash to cover next month’s payroll, taxes, and key expenses?” A forecast helps you plan ahead, spot problems early, and seize opportunities with confidence.

How to Get These Reports (Without Stress)

You don’t need to become an accounting expert—tools like QuickBooks, Xero, and others can generate these reports with just a few clicks. Even better, a good bookkeeper or accountant (hint: Your Business Accountant) can give you monthly financial reports tailored to YOUR business, plus help you understand what the numbers really mean.

If you want to DIY, set a calendar reminder to review these reports at the start of every month. Block out an hour to dig into your numbers—and don’t be afraid to ask questions or get help if something looks off.

Why Monthly Review Matters

Here’s the bottom line: Don’t wait for tax season or year-end. Reviewing these reports every month gives you:

Timely insights: See shifts and act fast

Early warnings: Catch problems before they snowball

Better planning: Make decisions with confidence

Peace of mind: Know exactly how your business is doing

You’ll be in control, not stuck reacting to surprises.

Get Support and Grow With Confidence

Need help setting up your monthly reports? Or want a friendly expert to talk you through what all those numbers really mean? Contact Your Business Accountant—it’s what we do! With solid financial insights, you can focus on what you love: growing your business.

Ready to dig deeper? Check out more articles and resources to boost your business smarts at Your Business Accountant’s blog.

.png)

Comments