Cash Flow vs. Tax Savings: Which Should You Prioritize This December? (And How to Balance Both)

- Susan Hagen

- Dec 24, 2025

- 5 min read

Here's the thing about December business planning: you don't have to choose between having cash in the bank and saving on taxes. I know it feels like these two goals are pulling you in opposite directions, but with the right approach, they can actually work together.

The real question isn't which one to prioritize, it's how to make smart moves that improve both your cash position and your tax situation. And with some significant changes from the One Big Beautiful Bill Act this year, there are more opportunities than ever to do exactly that.

Why This Feels Like an Either/Or Decision (But Isn't)

Most business owners see cash flow and tax savings as competing priorities because many tax strategies involve spending money now to save later. Buy equipment in December? That's cash out the door, even if it creates a tax deduction. Prepay expenses? Same thing, immediate cash impact for future tax benefits.

But here's what I've learned after years of helping businesses navigate year-end planning: the best strategies actually strengthen both areas. The key is understanding when tax moves naturally improve your cash position versus when they require careful trade-offs.

Understanding How Cash Flow and Taxes Really Work Together

Think of your tax bill as a future cash outflow. Every dollar you save on taxes is a dollar that stays in your business. So when you make a smart tax move in December, you're not just reducing this year's tax liability, you're improving your cash position for next year.

The timing aspect is what trips people up. You might spend $10,000 on equipment in December, which feels like it hurts cash flow. But if that purchase saves you $3,000 in taxes and you needed the equipment anyway, you've effectively reduced the real cost to $7,000. That's cash flow improvement disguised as a tax strategy.

The Game-Changers: Strategies That Boost Both Cash Flow and Tax Savings

Enhanced Depreciation Under the One Big Beautiful Bill Act

This year brought some significant changes that make equipment purchases more attractive than ever. The One Big Beautiful Bill Act, signed in July, enhanced bonus depreciation rules and increased Section 179 expensing limits to $2.5 million (with phaseout starting at $4 million).

What this means in plain English: if you buy qualified business equipment before December 31st, you can often deduct the entire purchase price this year instead of spreading it over several years. This creates an immediate tax benefit while giving you productive assets that should improve your business operations and cash generation.

The sweet spot? Equipment you were planning to buy in early 2026 anyway. Move those purchases into December and you get the full tax benefit while investing in your business's future earning potential.

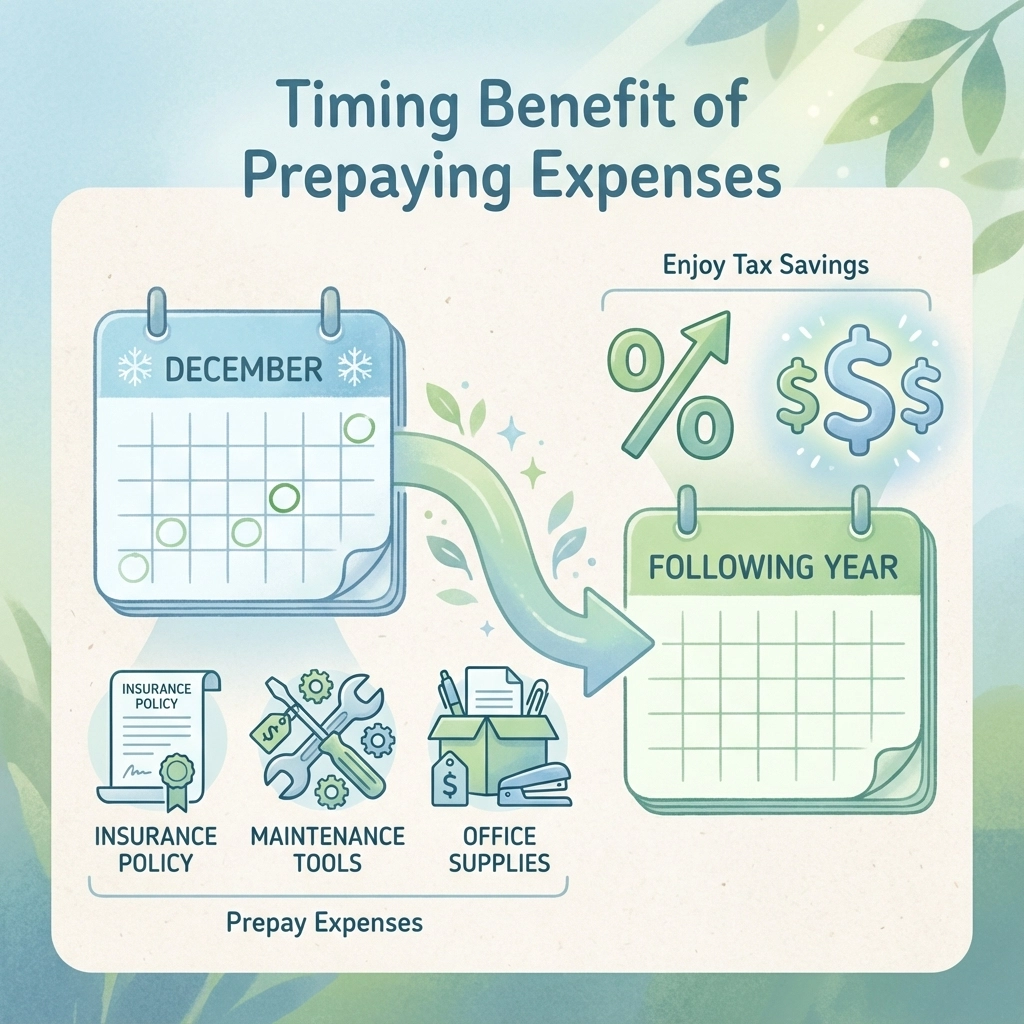

Strategic Expense Prepayment

Here's a move that sounds counterintuitive but works beautifully: prepaying certain business expenses. Under IRS rules, you can prepay up to 12 months of eligible expenses, like insurance premiums, maintenance contracts, or office supplies, and deduct them in the current year.

The cash flow math works when you have excess liquidity. Instead of that money sitting in a low-interest account, you're essentially getting a guaranteed return equal to your tax rate. If you're in a 25% tax bracket and prepay $4,000 in insurance, you save $1,000 in taxes while covering an expense you'd pay anyway.

When Cash Flow Should Take Priority

Protecting Your Operating Cushion

If your business is running tight on cash, don't chase tax deductions that could create operational problems. I've seen businesses prepay expenses or accelerate purchases only to struggle with payroll or supplier payments in January. No tax saving is worth putting your business operations at risk.

A good rule of thumb: maintain at least 2-3 months of operating expenses in readily available cash before considering aggressive tax moves that tie up funds.

Income Deferral Considerations

For cash-basis businesses, you can defer income by delaying invoicing or shipments until January. This pushes the tax liability to 2026, but it also means you won't have that cash available during the holiday season or early 2026.

Only defer income if you can genuinely operate without it. If you need that revenue for year-end expenses, employee bonuses, or Q1 cash flow, the tax benefit isn't worth the operational stress.

When Tax Savings Should Take Priority

Capital Loss Harvesting

If you have investment losses in your portfolio, December is your last chance to capture those tax benefits for 2025. Selling investments at a loss before December 31st creates capital losses that can offset gains and reduce ordinary income by up to $3,000.

This strategy has minimal cash flow impact, you're converting one asset (the losing investment) into cash while creating a tax benefit. You can even repurchase similar investments after 30 days to maintain your portfolio allocation.

Income Acceleration When Rates Are Rising

If you expect to be in a higher tax bracket next year, consider accelerating income into 2025. This might mean sending out invoices early, completing projects before year-end, or taking distributions from tax-deferred accounts.

Yes, this increases your current tax bill, but it can result in significant savings if your 2026 tax rate will be meaningfully higher.

Your December Decision Framework

Before making any year-end moves, run through this quick evaluation:

Step 1: Cash Flow Stress Test Model how each potential action affects your cash position through March 2026. Include the tax savings in your calculations: that April tax bill will be lower, which improves your spring cash flow.

Step 2: Two-Year Tax Comparison Compare your expected 2025 and 2026 tax situations. If rates are similar, traditional strategies (defer income, accelerate deductions) usually work well. If 2026 rates will be significantly different, you might reverse this approach.

Step 3: Business Strategy Alignment Don't make financial moves solely for tax purposes. Equipment purchases should align with business needs. Expense prepayments should cover things you'd buy anyway. The tax benefit should be the bonus, not the primary motivation.

Your December Action Plan

High-Priority Items (Do These First):

Review any equipment purchases planned for early 2026: consider moving them to December for enhanced depreciation benefits

Harvest capital losses in investment accounts before December 31st

Ensure all year-end accounting requirements are met, especially if you're on accrual accounting

Conditional Actions (Depends on Your Situation):

If you have strong cash reserves: Consider prepaying 12 months of recurring expenses like insurance or maintenance contracts

If you're cash-basis and have flexible billing: Delay invoicing until January if you can operate without that immediate cash

If you have unpaid vendor bills: Accelerate payments to increase current-year deductions, but only if your cash position allows it

Planning Conversation: Before finalizing major decisions, talk with your accountant or tax advisor. They can model the specific impact on your situation and ensure you're taking advantage of all available opportunities under the new legislation.

The Bottom Line

The best year-end strategies don't force you to choose between cash flow and tax savings: they improve both. With the enhanced depreciation rules and other opportunities available this year, there are more ways than ever to align these goals.

The key is being strategic rather than reactive. Don't scramble to buy equipment you don't need just for a tax deduction. Don't prepay expenses if it creates cash flow stress. But do look for opportunities where tax-smart moves support your business strategy and financial health.

Remember, you have until December 31st to implement most of these strategies, but the best opportunities often require some planning and coordination. Start evaluating your options now, and you'll finish the year in a stronger position on both fronts.

.png)

Comments