Financial Reports Explained in Under 10 Minutes: What Every Small Business Owner Needs to Know

- Susan Hagen

- Oct 15, 2025

- 5 min read

Let's be honest – most small business owners didn't start their companies because they love diving into financial reports. You probably launched your business because you're passionate about your product or service, not because you wanted to spend evenings analyzing spreadsheets. But here's the thing: understanding your financial reports isn't just about keeping the books tidy – it's about understanding the heartbeat of your business.

Think of financial reports as your business's vital signs. Just like a doctor checks your blood pressure, temperature, and pulse to understand your health, these reports tell you whether your business is thriving, just getting by, or heading for trouble. And the best part? Once you understand the basics, you can review them in just a few minutes and make decisions that could save or make you thousands of dollars.

The Big Three: Your Essential Financial Reports

Every small business owner needs to master three core financial statements. Think of them as the holy trinity of business finances: the Balance Sheet, Income Statement (also called Profit & Loss), and Cash Flow Statement. Each tells a different part of your business story, and together they give you the complete picture.

The Balance Sheet: Your Business's Net Worth Statement

The balance sheet is like taking a financial selfie of your business at a specific moment in time. It answers one crucial question: "What is my business worth right now?"

What Goes Into a Balance Sheet

Assets are everything your business owns that has value. This includes:

Cash in your bank accounts

Money customers owe you (accounts receivable)

Inventory sitting in your warehouse

Equipment, computers, and furniture

Property or buildings you own

Assets are divided into two categories: current assets (things you can turn into cash within a year) and fixed assets (long-term stuff like equipment and buildings).

Liabilities are what your business owes to others:

Outstanding loans

Bills you haven't paid yet (accounts payable)

Credit card debt

Taxes owed

Employee wages due

Owner's Equity is what's left over after you subtract all your liabilities from all your assets. It's essentially what you'd pocket if you sold everything and paid off all debts.

The Golden Rule

Here's the magic formula that makes the balance sheet work: Assets = Liabilities + Owner's Equity. This equation must always balance (hence the name "balance sheet"). If it doesn't balance, something's wrong with your numbers.

The Income Statement: Your Profit Report Card

If the balance sheet is a snapshot, the income statement is a movie – it shows what happened over a period of time (usually a month, quarter, or year). This report answers the burning question: "Did I make money or lose money?"

Breaking Down Your Income Statement

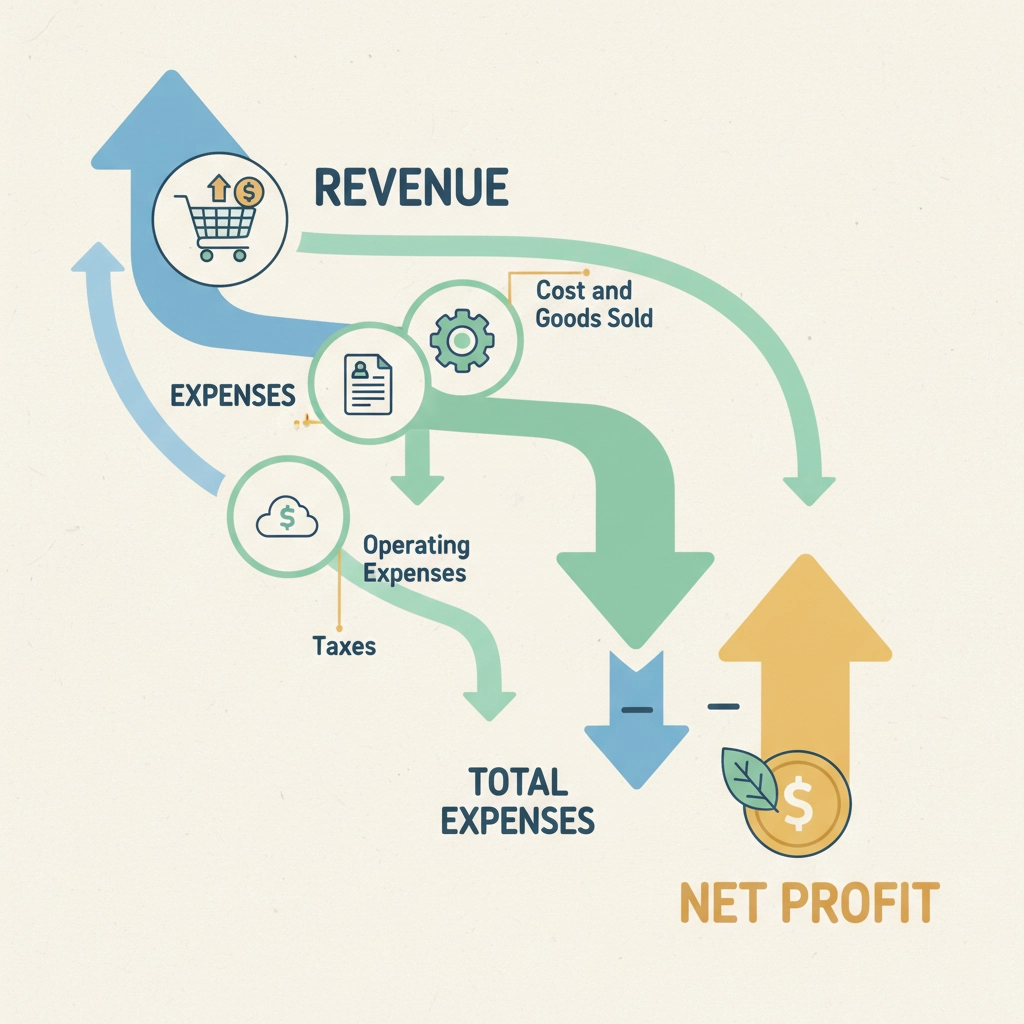

Revenue is all the money your business earned from sales. This is your gross income before any expenses.

Cost of Goods Sold (COGS) represents what it directly costs to make your product or deliver your service. For a bakery, this would include flour, eggs, and sugar. For a consultant, it might include subcontractor fees.

Gross Profit is what you get when you subtract COGS from revenue. This tells you how much money you're making before paying for all the other business expenses.

Operating Expenses include everything else it takes to run your business:

Rent and utilities

Employee salaries

Marketing and advertising

Insurance

Office supplies

Professional services (like your accountant!)

Net Income is your bottom line – what's left after all expenses. This is the profit (or loss) that ends up in your pocket or gets reinvested in the business.

A Real-World Example

Let's say your small marketing agency brought in $100,000 in revenue last quarter. You paid $30,000 to freelancers (COGS), so your gross profit is $70,000. Your operating expenses were $45,000 for office rent, salaries, software subscriptions, and other costs. Your net income would be $25,000 – not bad for three months of work!

The Cash Flow Statement: Your Business's Pulse

Here's where many small business owners get surprised: you can be profitable on paper but still run out of cash. The cash flow statement tracks the actual money moving in and out of your business, showing you whether you can pay your bills next month.

Three Types of Cash Flow

Operating Cash Flow shows cash from your day-to-day business operations. This includes money from customers, payments to suppliers, and operating expenses.

Investing Cash Flow tracks money spent on or received from business investments like equipment, vehicles, or property.

Financing Cash Flow includes money from loans, investor contributions, or payments on debt.

Why Cash Flow Matters More Than You Think

You might show a $10,000 profit on your income statement, but if customers are slow to pay and you've got big bills due next week, you could still be in trouble. The cash flow statement helps you spot these situations before they become crises.

Putting It All Together: What These Reports Tell You

When you look at all three reports together, you get powerful insights:

Are you profitable? (Income Statement)

Are you solvent? (Balance Sheet)

Can you pay your bills? (Cash Flow Statement)

These reports also help you spot trends. Is your profit margin shrinking? Are customers taking longer to pay? Is your debt growing faster than your assets? Catching these patterns early lets you make adjustments before small problems become big ones.

Common Small Business Owner Mistakes

Mistake #1: Only looking at bank balances. Your checking account balance doesn't tell the full story. You might have big bills coming due or money tied up in inventory.

Mistake #2: Ignoring accounts receivable. Money customers owe you isn't the same as money in the bank. If invoices are aging, that's a cash flow problem waiting to happen.

Mistake #3: Not tracking expenses properly. Mixing personal and business expenses, or failing to categorize costs correctly, makes your reports unreliable.

Mistake #4: Waiting until tax time. Financial reports aren't just for the IRS. Monthly reviews help you make better decisions year-round.

Your 10-Minute Monthly Financial Checkup

Here's a quick routine to stay on top of your finances:

Check your cash position – Can you cover next month's expenses?

Review your profit margin – Is it improving or declining?

Look at accounts receivable – Are customers paying on time?

Examine your debt-to-asset ratio – Is debt growing faster than your assets?

Compare to previous months – What trends do you see?

Getting Help When You Need It

While understanding the basics is crucial, you don't have to become a financial expert overnight. Good accounting software can generate these reports automatically, and working with a qualified bookkeeper or accountant ensures your numbers are accurate and meaningful.

The key is knowing what these reports are telling you so you can ask the right questions and make informed decisions. Whether you're applying for a loan, planning for growth, or just trying to understand why cash is tight despite good sales, these three financial statements give you the answers you need.

Remember, financial reports aren't just paperwork – they're your roadmap to business success. Spend those 10 minutes each month reviewing them, and you'll be amazed at how much clearer your business decisions become. Your future self (and your bank account) will thank you.

For more insights on managing your small business finances effectively, check out our other resources on cash flow management and strategic financial planning.

.png)

Comments