The Ultimate Guide to Year-End Financial Reports: Everything You Need for Tax Season Success

- Susan Hagen

- Dec 8, 2025

- 5 min read

As we approach the final stretch of 2025, it's time to get serious about your year-end financial reports. I know, I know – it's not exactly the most exciting topic to think about during the holiday season, but trust me, putting in the work now will save you major headaches come tax time.

Let's break down everything you need to know about creating rock-solid year-end financial reports that'll make tax season a breeze (well, as breezy as tax season can be!).

Why Year-End Financial Reports Matter More Than You Think

Before we dive into the nitty-gritty, let's talk about why these reports are so crucial. Your year-end financial reports aren't just paperwork to satisfy the IRS – they're a powerful tool for understanding your business's health and setting yourself up for success in the coming year.

These reports help you:

Identify trends in your revenue and expenses

Spot areas where you're hemorrhaging money

Make informed decisions about next year's budget

Maximize your tax deductions

Keep your accountant (and the IRS) happy

The Big Three: Essential Financial Reports You Need

There are three main financial reports that form the backbone of your year-end package. Think of them as the holy trinity of business financials.

1. Profit & Loss Statement (P&L)

Your P&L statement is like a movie of your business's financial performance over the entire year. It shows:

Total revenue (all the money coming in)

Cost of goods sold (direct costs to produce your product/service)

Operating expenses (everything else you spend to run the business)

Net income (what's left after all expenses)

How to Read Your P&L Like a Pro:

Look for trends month-to-month – are there seasonal patterns?

Calculate your gross profit margin (gross profit ÷ revenue)

Identify your biggest expense categories

Compare this year's numbers to last year's

2. Balance Sheet

If your P&L is a movie, your balance sheet is a snapshot. It shows your financial position at a specific point in time (typically December 31st). The balance sheet follows this equation: Assets = Liabilities + Owner's Equity.

Key things to check:

Cash balances (are you cash-heavy or cash-poor?)

Accounts receivable aging (who owes you money?)

Inventory levels (are you sitting on too much stock?)

Debt levels (how leveraged are you?)

3. Cash Flow Statement

This report tracks how cash actually moved through your business. It's divided into three sections:

Operating activities (day-to-day business operations)

Investing activities (buying/selling equipment, investments)

Financing activities (loans, owner contributions/withdrawals)

Your Year-End Closeout Checklist

Ready to tackle this like a boss? Here's your step-by-step checklist to ensure nothing falls through the cracks:

Phase 1: Account Reconciliation (Start Here!)

Bank Accounts:

Reconcile all checking accounts through December 31st

Reconcile all savings accounts

Match credit card statements to your records

Review and record any bank fees or interest

Other Accounts:

Reconcile merchant accounts (PayPal, Square, Stripe)

Update loan balances and verify interest calculations

Review investment account statements

Pro tip: Don't just match balances – actually review each transaction. You'd be surprised how many duplicate charges or errors you'll find!

Phase 2: Revenue Recognition

Record all December sales, even if payment hasn't been received

Issue invoices for any work completed but not yet billed

Review 1099s you'll need to issue to contractors

Double-check sales tax calculations and payments

Phase 3: Expense Management

Enter all receipts and bills through December 31st

Review credit card statements for missing expenses

Calculate depreciation on equipment and assets

Accrue for expenses incurred but not yet paid (utilities, etc.)

Review prepaid expenses and adjust accordingly

Common expenses people forget:

Professional licenses and subscriptions

Software subscriptions paid annually

Insurance that was prepaid

Office supplies purchased in bulk

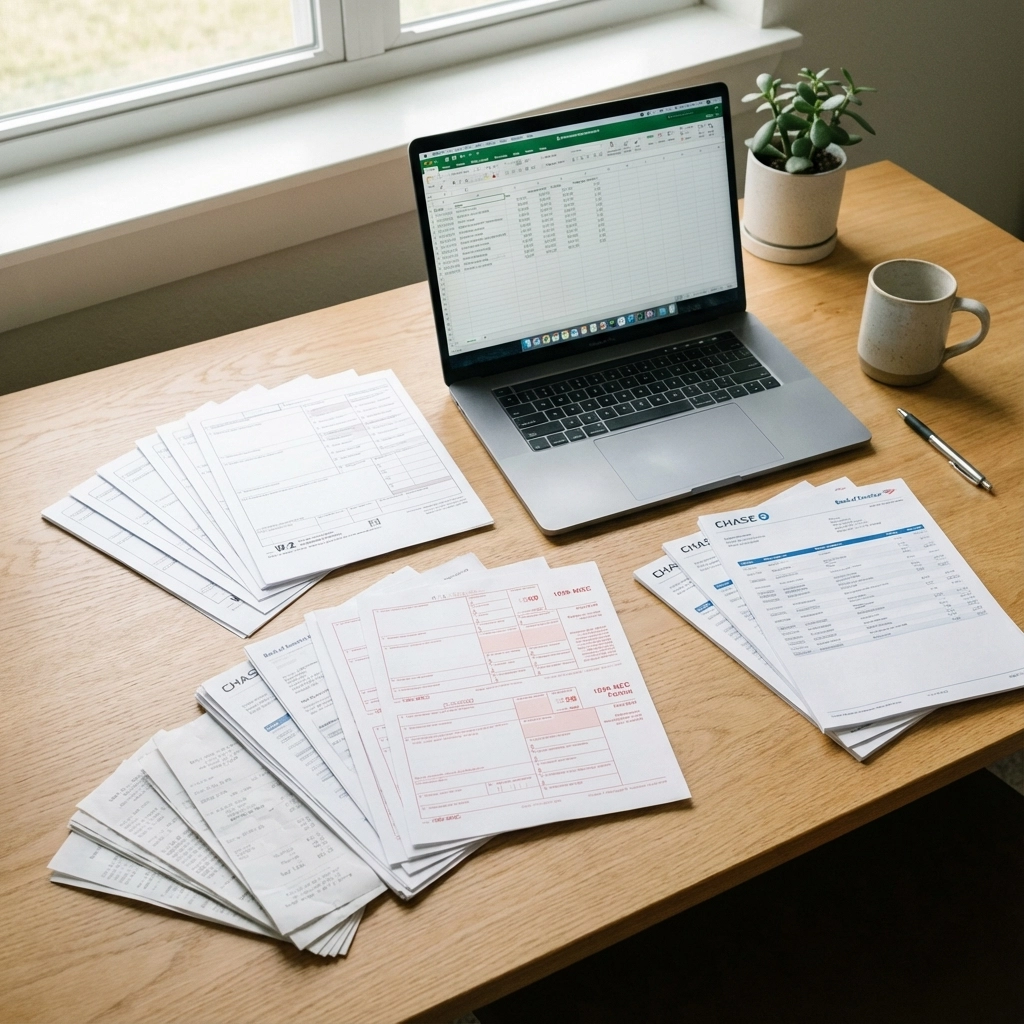

The Document Hunt: What You Need to Gather

Nothing's worse than scrambling to find paperwork in February when your tax deadline is looming. Start collecting these documents now:

Income Documents

W-2s from any employment

1099-MISC for contract work

1099-NEC for non-employee compensation

1099-K from payment processors

Bank statements showing interest earned

Investment statements (1099-DIV, 1099-INT, 1099-B)

Expense Documentation

Receipts for business expenses (meals, travel, supplies)

Home office expense calculations

Vehicle mileage logs

Professional development and training costs

Equipment purchases over $2,500 (for depreciation)

Health insurance premiums (if self-employed)

Other Important Documents

Loan statements and interest paid

Property tax statements

Estimated tax payment records

Prior year tax returns (for comparison)

Advanced Tips for Reading Your Reports

Once you've got your reports generated, here's how to dig deeper and extract valuable insights:

Ratio Analysis

Calculate these key ratios to benchmark your performance:

Gross Profit Margin: (Revenue - COGS) ÷ Revenue

Current Ratio: Current Assets ÷ Current Liabilities

Debt-to-Equity Ratio: Total Debt ÷ Owner's Equity

Trend Analysis

Don't just look at the numbers – look at the trends:

Is revenue growing quarter-over-quarter?

Are expenses growing faster than revenue?

What's your cash burn rate?

Industry Benchmarking

Compare your key metrics to industry averages. If your gross margin is significantly lower than competitors, you need to investigate why.

Common Year-End Mistakes to Avoid

I've seen these mistakes countless times, and they can really mess up your financial picture:

The "Oops, I Forgot" Mistakes:

Not recording December sales until January

Forgetting to accrue expenses

Missing depreciation calculations

Not reconciling all accounts

The "I'll Deal With It Later" Mistakes:

Postponing difficult reconciliations

Ignoring small discrepancies that add up

Not following up on missing documentation

The "Close Enough" Mistakes:

Rounding numbers instead of being precise

Making assumptions instead of researching

Not reviewing prior year comparisons

Technology That Makes This Easier

If you're still doing this stuff manually, you're making your life way harder than it needs to be. Modern accounting software can automate most of these processes:

QuickBooks Online: Great for most small businesses

Xero: User-friendly with excellent bank feed integration

FreshBooks: Perfect for service-based businesses

These platforms can automatically categorize transactions, reconcile accounts, and generate reports with just a few clicks.

Setting Yourself Up for Next Year

While you're in the thick of year-end work, take some time to set yourself up for success in 2026:

Schedule monthly financial reviews

Set up automatic bank feeds

Create expense tracking systems

Plan for estimated tax payments

Set financial goals based on this year's performance

Final Thoughts

Look, I get it – year-end financial reports aren't exactly thrilling. But think of them as the foundation for everything else you want to accomplish in your business. The insights you gain from this process will guide your decisions, help you grow smarter, and keep you out of trouble with the tax authorities.

Start now, take it step by step, and don't be afraid to ask for help if you need it. Your future self (especially the one dealing with tax season) will thank you for putting in the work now.

Remember, good financial reports aren't just about compliance – they're about building a stronger, more profitable business. So roll up your sleeves, grab your favorite caffeinated beverage, and let's get these reports done right!

.png)

Comments