What to Do If You Get a Letter from the IRS: Steps for Small Businesses

- Susan Hagen

- Sep 5, 2025

- 4 min read

Getting mail from the IRS isn’t anyone’s idea of a good day—especially as a small business owner. But before panic sets in, take a deep breath. IRS letters are more common than you might think, and with a clear plan of action you can tackle the issue head-on, keep your business moving, and maintain your peace of mind.

1. Don’t Panic—Start by Reading the Letter Carefully

It sounds basic, but it’s the most important first step. As soon as you get an IRS notice:

Read it from top to bottom. Skim nothing. Look for specifics like tax year, the issue at hand, what action is being requested, and deadlines.

Confirm it’s actually from the IRS. An authentic notice will have the IRS logo, a notice or letter number (such as CP14, CP2000, or LTR2205-B), and legitimate contact details. If anything smells fishy—typos, weird formatting, or odd sender info—call the official IRS line at 1-800-829-1040.

2. Understand What the IRS Wants

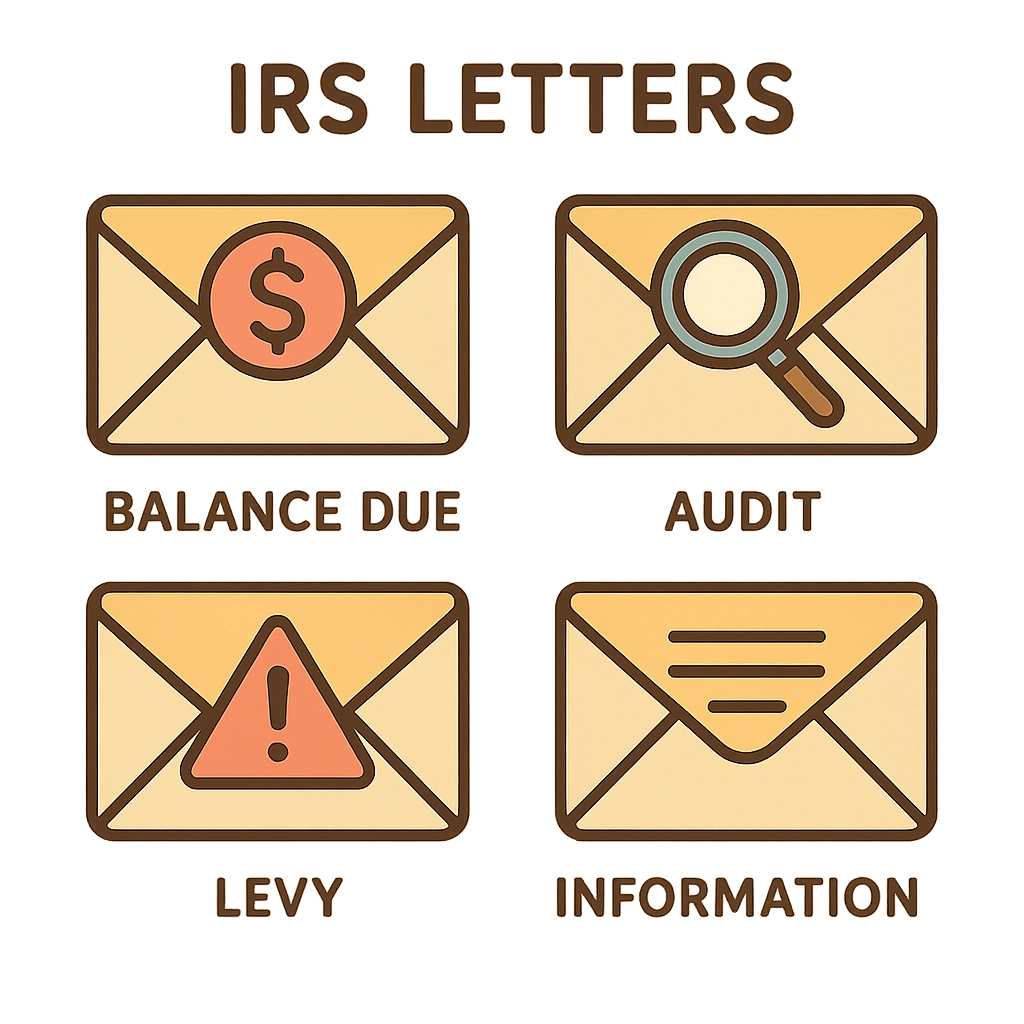

IRS letters usually fall into a few main categories. Figuring out which you have will clarify your next move:

Balance Due: (e.g., CP14) The IRS says you owe taxes that haven’t been paid.

Notice of Intent to Levy: (e.g., CP90) The IRS is warning of levy or collection actions.

Request for Information: The IRS wants to clarify something on your tax return.

Audit/Examination Notification: (e.g., LTR2205-B) Your business return is being examined.

Correction Notice: The IRS adjusted your return—sometimes in your favor!

Don’t assume the worst case. Some notices simply correct a math error or ask for clarification.

3. Gather Your Documentation

Now’s the time to play detective and grab everything you’ll need. For business-related letters, you should:

Pull a copy of the tax return related to the year on the letter.

Gather receipts, bank statements, invoices, payroll records, mileage logs—basically, any backup for the items the IRS is questioning.

If you’re missing any part of your filed return, request a transcript using the IRS “Get Transcript” tool, call 1-800-908-9946, or file Form 4506-T.

The more organized you are, the faster (and less stressful) this step will be.

4. Decide: Do You Agree or Disagree With the IRS?

It’s totally okay if you need a day to mull it over. Here’s what to do next:

If You Agree

Follow the instructions: If extra tax is due, pay it as soon as possible. Include the notice number on your check or money order, or pay online.

Send any requested forms or info: Attach copies (never originals) of supporting documents, and keep meticulous records—screenshots, emails, mail receipts.

If You Disagree

Don’t ignore it. Silently fuming won’t make it go away—and can rack up penalties.

Write a clear, polite letter stating your case. Attach copies of whatever documentation supports your position. Respond directly to the address or fax number provided on your notice.

Keep a copy of everything you send. The IRS receives huge volumes of mail, and lost paperwork is frustratingly common.

5. Know the Deadlines and Respond Promptly

Most IRS letters request a response within 30 days, but always check your notice for exact dates. Blowing off a deadline can mean:

Additional penalties and interest

Loss of appeal rights

Automated collection actions like liens or levies

Even if you’re waiting on additional documents, it’s better to contact the IRS and explain your situation than to do nothing. A proactive response buys time and goodwill.

6. When to Call in a Pro

When the IRS is asking for minor clarifications, you can often handle things yourself. But reach out for professional help if:

You’re dealing with a business audit or formal examination

The amount in question is significant

The notice is unclear, threatens immediate action, or involves legal jargon

You’re already behind on taxes or have a history of IRS issues

A qualified accountant or tax pro (like those at Your Business Accountant) can help you craft the best response, represent you before the IRS, and make sure you’re not exposing yourself or your business to bigger problems.

7. Protect Your Rights and Business

Every IRS letter comes with certain rights and options. If you disagree with their findings, you can often request an appeal or conference with an IRS representative. Don’t waive these rights by missing a deadline.

Always:

Save every IRS letter or notice you get

Log dates, times, and names when you call the IRS

Send anything time-sensitive by certified mail with tracking

8. Common IRS Letters Small Businesses Receive

A quick cheat-sheet for future reference:

Notice/Letter | What It Means |

CP14 | Balance due—taxes owed |

CP90/L1058 | Final notice of intent to levy assets |

CP2000 | Underreported income identified |

LTR2205-B | Your business tax return is being examined |

CP523 | Installment agreement default notice |

CP501/CP503 | Reminder or urgent notice of due taxes |

If you’re unsure, the IRS website has a lookup tool for every notice type as well.

9. Preventing Future Surprises

Tired of IRS letters? Here’s how to reduce the odds next year:

Do regular bookkeeping. Monthly check-ins make tax time (and surprise notices) way less likely. Services like Your Business Accountant’s Monthly Bookkeeping are designed for busy owners.

Double-check returns before filing. Catching simple errors early saves headaches later.

Keep documentation for at least 3–7 years. Yep, even for “quiet” years.

Consult a professional before handling tricky transactions (like buying a business, hiring contractors, or claiming unusual deductions).

If you’re staring at that IRS letter right now, know this: you’re not alone, and you’ve got options. Step-by-step attention, documentation, and (when needed) expert help will get you through almost any IRS curveball. If you need support or a second opinion, our team at Your Business Accountant is always here to back you up.

.png)

Comments